If you’re buying school supplies for your children in kindergarten through 12th grade, you may qualify for one or both of these tax relief programs:

• K–12 Education Subtraction

• K–12 Education Credit

Save your receipts, because both programs can help lower your taxes and may provide a larger

refund when filing your Minnesota income tax return.

Last year, more than 19,000 families received the K-12 Education Credit and saved an average

of $261. Nearly 130,000 families received the K-12 Education Subtraction with an average subtraction of $1,207.

Common Expenses That Qualify:

• School supplies (pencils, paper, calculators)

• Educational computer hardware and software

• Tutoring K-12 curriculum by a qualified instructor

• Rental or purchase of musical instruments used during school

Expenses That Do Not Qualify:

▪ School supplies not used in education (backpacks, tissues, organizers)

▪ Clothing, including school uniforms (except required gym clothes)

▪ School lunches

▪ Family trip to museum or zoo

Do I qualify?

To qualify for either the credit or subtraction, both of these must be true:

▪ You purchased educational services or materials to assist with your child’s education

▪ Your child is attending kindergarten through 12th grade at a public, private, or home school

Income limits for Each Program

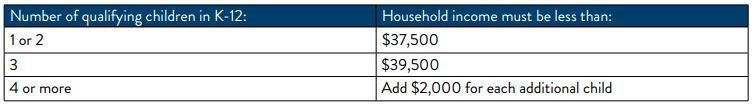

K-12 Education Credit: Your household income (taxable and nontaxable income) must be below the levels shown here. If you qualify for the credit, you must file a Minnesota return to claim a refund.

K-12 Education Subtraction: There are no income limits for the education subtraction.

For more information on these programs and other valuable tax information, visit www.revenue.state.mn.us and enter K12 in the Search box or call us at 651-296-3781 or 800-652-9094.